Vienna, 5th of June 2019 – Vienna-based fintech Bitpanda will launch the Bitpanda Global Exchange, a global cryptocurrency exchange for experienced traders, professionals and institutions. The Bitpanda platform will also get its own ecosystem token through an Initial Exchange Offering (IEO). BEST (Bitpanda Ecosystem Token) will offer a range of benefits and incentives to nearly 1 million Bitpanda users.

- The Bitpanda Global Exchange allows global crypto-to-crypto and fiat-to-crypto trading

- Popular trading pairs including BTC/EUR, BTC/USDT, ETH/EUR, XRP/EUR, MIOTA/EUR, ETH/BTC, XRP/BTC, MIOTA/BTC, PAN/BTC, BEST/BTC, BEST/EUR and BEST/USDT.

- Fiat deposits (Euro, Swiss Franc and British Pound) in the majority of European countries; withdrawals available globally

- Bitpanda Ecosystem Token (BEST) IEO launches on July 9th, 2019

- BEST offers up to 25% trading fee discount plus additional rewards and perks

- Growing list of popular trading pairs and funding options

- Competitive fee structure

- State-of-the-art API

- Highest security standards

- BEST trading will start on August 7th, 2019

Bitpanda, the Viennese fintech with around 1 million users and more than 100 employees is launching the Bitpanda Global Exchange, a digital asset exchange for experienced traders, professionals and institutions. Bitpanda Global Exchange (Bitpanda GE) builds upon the popular, easy-to-use Bitpanda platform, which is the go-to-place to buy, sell and store digital assets like Bitcoin, Ethereum, digitised gold and more in Europe.

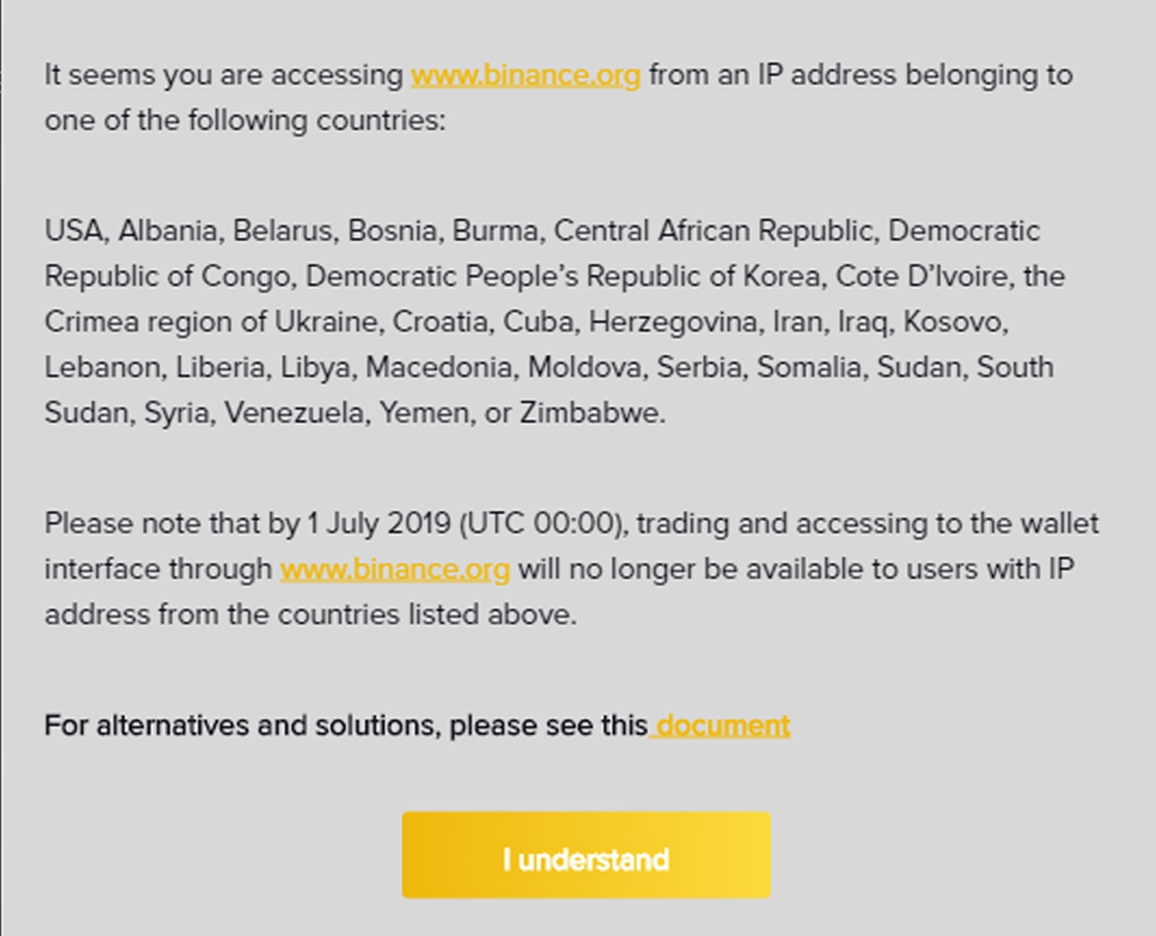

Bitpanda GE is available globally for crypto-to-crypto trading. Verified Bitpanda users within the majority of European countries can also deposit Euro, Swiss Franc and British Pound. Bitpanda GE is closely connected to the Bitpanda platform, which means that users can move funds easily between them. Bitpanda GE launches with popular trading pairs such as BTC/EUR, BTC/USDT, ETH/EUR, XRP/EUR, MIOTA/EUR, ETH/BTC, XRP/BTC, MIOTA/BTC, PAN/BTC, BEST/BTC, BEST/EUR and BEST/USDT and many more to come.

“Offering experienced users, a way to trade digital assets and building the largest Euro exchange is the next logical step for us. Bitpanda has been around since 2014 and we are a key player in Europe. We can build on a lot of synergies and experience,” says Bitpanda CEO Eric Demuth.

As part of the Bitpanda Global Exchange launch, Bitpanda is also launching its first Initial Exchange Offering (IEO). The Bitpanda Ecosystem Token (BEST) is the coin of the Bitpanda ecosystem that offers users a wide range of benefits and perks within the Bitpanda ecosystem. The growing community of around 1 million Bitpanda users will be able to benefit from a wide range of rewards and perks. For example, they will get a reduction of up to 25% on Bitpanda trading fees, gain priority access to the upcoming Bitpanda Launchpad, which will be available later and allow the launch of third party IEOs.

“BEST will play a vital role in Bitpanda’s global expansion and in making our vision of democratising personal finance and investing. BEST is the fuel of the Bitpanda ecosystem, which means that the Bitpanda platform, the Bitpanda Global Exchange and future products like the Bitpanda Launchpad will make heavy use of incorporating BEST”, says Bitpanda CEO Eric Demuth.

About Bitpanda

Bitpanda is a fintech based in Vienna, Austria founded in 2014 by Eric Demuth, Paul Klanschek and Christian Trummer. The company is a firm believer in the innovative power of cryptocurrencies, digitised assets and blockchain technology. Bitpanda’s mission is to tear down the barriers to investing and bring traditional financial products to the 21st century. Today, Bitpanda has around 1 million users and more than 100 team members. With a PSD2 payment service provider license, state-of-the-art security and streamlined user experience, Bitpanda has grown into a popular trading platform for newbies and experts alike. Users can currently trade Bitcoin, Ethereum, gold and over 20 other digital assets.

The post Bitpanda goes global: Announcing the Bitpanda Global Exchange and the IEO for the ecosystem token BEST appeared first on Bitcoin News.

from Bitcoin News https://www.cryptocynews.com/bitpanda-goes-global/

via

Bitcoin News

via

Bitcoin News Today