Key Insights:

- Bitcoin’s upward trend is expected to continue as market confidence grows and the 2024 halving event approaches.

- The fees-to-rewards ratio is essential in the network’s durability and miners’ acceptance, which might boost BTC’s long-term potential.

- Traders may consider buying BTCUSD during drops in the middle or lower channel to reduce risks, with the possibility of an upward trend towards $32,000.

Investors are expressing worries about the potential impact on the value of Bitcoin as the 2024 halving approaches. The halving happens every four years and reduces the mining reward by half. Historically, this decrease in supply has been accompanied by a surge in demand, leading to an increase in the price of Bitcoin.

The financial sustainability of the Bitcoin network heavily relies on the fees-to-rewards ratio, which is determined by contrasting the fees paid by users to miners for including their transactions in the blockchain against the block rewards earned by miners for adding new blocks to the network. A high fee-to-rewards ratio indicates a solid and lasting network, whereas a low ratio could reduce miner motivation and potentially create security issues.

As the fees-to-rewards ratio increases, the network becomes more attractive to miners, which could result in greater adoption and future growth, thereby enhancing investor and trader confidence in BTC. This development is a positive sign of the network’s strength and potential for sustained success.

BTC soars amid bullish sentiment

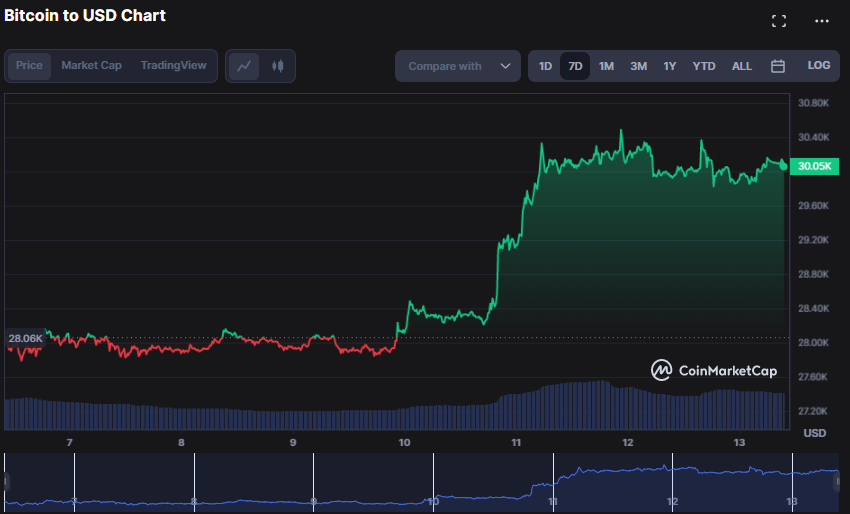

Last week, the bulls of Bitcoin (BTC) dominated over the bears, causing the prices to soar from $27,738.76 to an intra-month high of $30,462.48 in just a few hours. As of now, this bullish trend is still ongoing, with prices increasing by 0.72% to $30,225.81 at press time.

BTC/USD 7-day price chart (source: CoinMarketCap)

On the 7-day BTCUSD price chart, the Keltner Channel bands are expanding, with the top channel currently at $29307.46, the central channel at $24212.74, and the bottom channel at $19117.47. This suggests that BTCUSD is experiencing an upward trend, with the possibility of further price increases. To minimise risk, traders may consider purchasing BTCUSD during declines towards the middle or lower channel and setting a stop loss below the lower channel.

The price movement above the upper bar and the formation of three consecutive green candlesticks, with a reading of $30216.51, suggest that the bullish momentum is intensifying, indicating a potential for an upward trend.

The current rate of price change is 38.57, indicating a faster increase than the previous period. This strengthens the likelihood of a sustained upward trend.

If the intra-month high of $30,462.48 is exceeded, the subsequent resistance level that could stimulate more buyers and push the price even higher is at $32,000, an extraordinary psychological level. On the other hand, if the bears reduce the price, the next support level may be at $28,000, which has proven to be a robust support level during previous price corrections.

BTC/USD 7-day price chart (source: TradingView)

Conclusion

Finally, Bitcoin’s upcoming halving and growing fees-to-rewards ratio indicate the possibility for long-term success, while the present rally and technical indications point to a price climb towards $32,000.

The post Bitcoin’s Positive Trend Continues: Will $32K be the Next Resistance Level? first appeared on CryptocyNews.com.

from CryptocyNews.com https://www.cryptocynews.com/bitcoins-positive-trend-continues-will-32k-be-the-next-resistance-level/

via Bitcoin News

via Bitcoin News Today

No comments:

Post a Comment